I hate to be the bearer of bad news, but working a regular job is not enough to create financial freedom. Creating multiple streams of income is a better plan for long term wealth building. This article will highlight my twelve current sources of income as well as additional income sources I plan to create in the future.

Don’t Depend on Full-Time Jobs

Imagine having the comfort of knowing you aren’t relying on just one paycheck. The concept of multiple income streams allows you to diversify your earnings and create financial stability. This approach can protect you from unexpected job loss and economic downturns.

Creating multiple income streams can begin with simple steps. Active options like freelance work or part-time gigs bring in immediate income. Over time, you can incorporate passive income opportunities such as investments or angel investing to build long-term wealth. Passive income options, including investment in real estate or stocks, also enhance your financial security.

You might start with a online income stream side hustle, like freelance writing or launching a blog. These can grow into lucrative opportunities with dedication and time. One blog can spin off into numerous passive income ideas like online courses, digital products, or a YouTube channel.

By establishing a mix of revenue streams, you’re better positioned to navigate life’s uncertainties. This strategy not only enhances financial independence but also provides opportunities for personal growth and new experiences.

Exploring different income streams could lead you to discover a new passion or skill. As you venture into these areas, you’ll likely uncover various partners and platforms to support your journey.

Why Multiple Income Streams Are Essential for Financial Freedom

Relying solely on a single source of income can leave you vulnerable, especially during economic downturns. By diversifying your income, you create a buffer against unexpected financial shocks. This enhances your financial security, allowing you to pursue goals like purchasing a home or saving for retirement more confidently.

Multiple income streams provide financial stability by ensuring that you aren’t dependent on just one paycheck. In today’s world of work, where job insecurity is common, having various income sources can offer peace of mind. It reduces the fear of job loss or sudden economic changes affecting your livelihood.

Balancing multiple income streams can also accelerate your journey toward paying off debts, like student loans. The extra cash flow can be strategically used to reduce your financial burdens faster. This additional revenue fosters a sense of control over your financial destiny.

You have the opportunity to explore different income sources, which can align with personal passions or hobbies. This not only generates money but can also enrich your life by integrating personal interests with your financial strategy. Adopting an income diversification approach is a proactive step towards financial empowerment.

Incorporating various income streams equips you to handle life’s financial challenges more effectively. Whether it’s a part-time job, passive income from investments, or freelance work, every added source contributes to a comprehensive financial framework. By adopting this mindset, you can enhance your overall financial resilience and future-proof your finances.

Your First Income Stream

Starting with a full-time job is a common way to build your first income stream. It provides stability while you explore other opportunities. As you gain experience, consider using your free time to develop side hustles for extra money.

Options for side hustles are numerous. Don’t let what you perceive to be a good job stop you from a great thing like financial freedom.

Exploring multiple income streams allows you to diversify and increase your earnings over time. Start small, set achievable goals, and expand your income sources as your confidence and skills grow.

What Types of Income Streams You Should Look For

If you have skills in graphic design, use platforms like Fiverr or Upwork to offer your services. These gigs can provide substantial extra income.

Creating an online business is another route. Platforms like Shopify make setting up an online store straightforward. Selling products related to your interests can build a reliable side business for generating extra cash.

Consider using social media platforms to promote your ventures. This can include creating content for Instagram or starting a YouTube channel. With consistent effort, these channels can eventually bring in enough income to support your lifestyle.

For those interested in technology, developing a mobile app could be a lucrative project. There’s potential for significant reward if your app meets a market need and offers unique features.

Don’t forget affiliate marketing as a passive income stream. By partnering with brands, you can earn commissions for sales made through your referrals. This works great when you already have a following on a similar platform or social media.

A Look at My Current Income Streams

My first attempt at income diversification came 18 years ago when I launched my network marketing business. Since that time I have evolved and grown as my life has changed. Here I will highlight every type of income I am currently using to be a full-time digital nomad.

1. Network Marketing

In network marketing, your income derives from sales and recruitment efforts. Success often hinges on both selling a product and recruiting new distributors. You can earn commissions on your sales and a percentage of your team’s sales. A strong support network can be beneficial, offering training and mentorship.

I’ve always said that the best network marketing companies are ones where the person selling the item or service provides major value aside from just linking the person to the product. If the only value being provided is a website link, it will probably not turn into a big money making venture.

2. Airbnb

Using Airbnb allows you to profit from rental properties or a spare room. You can manage bookings and earn rental income through the platform. Maintaining high standards in cleanliness and responsiveness helps achieve positive reviews.

Most people assume Airbnb can only be done by people who have a lot of capital to secure investment properties. The reality is, we turned the home we lived in as a family into a rental property. At first we only rented it out part-time and used those rental times to go on vacation. Now because of increasing demand, we have made it a full-time Airbnb and moved abroad.

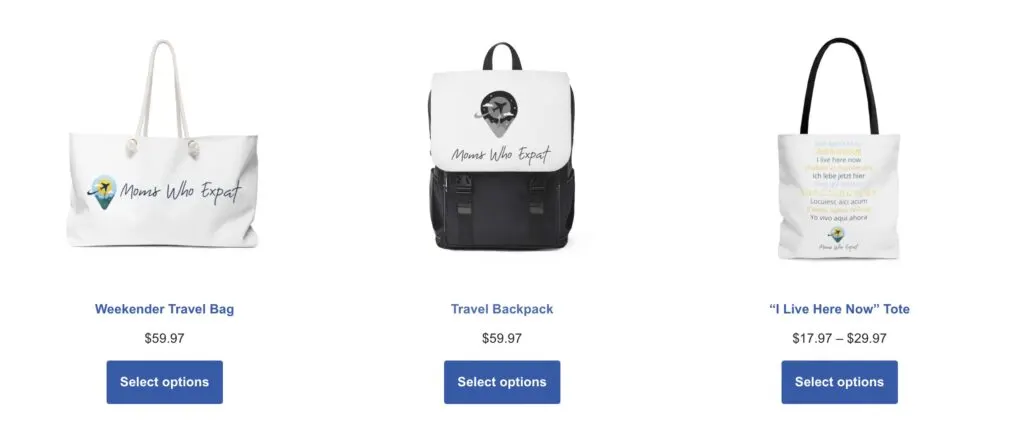

3. Branded Merch

Selling branded merchandise includes creating items such as T-shirts, mugs, or hoodies with unique designs. You can leverage online platforms like Etsy or Shopify to reach customers. Original designs attract niche markets, resulting in higher margins.

Partnering with print-on-demand services can lower initial costs, reducing financial risks. I turn my own designs into products that appeal to my already existing target market. The same moms who are my clients for network marketing are the buyers of my Moms Who Expat branded products.

4. Travel Agent Services

Offering travel agent services can be lucrative for those with a passion for travel. You book flights, accommodations, and tours for clients while earning commissions. Personalized travel experiences and exclusive deals can differentiate your services.

Networking with suppliers can enhance your offerings. Knowledge of popular destinations and travel trends are advantageous in creating memorable and amazing trips. My full-time travel lifestyle allows me to offer nitty gritty details such as exact restaurant recommendations and different options for transportation than the average commission based travel website.

5. E-Courses

Creating e-courses involves sharing your expertise through structured online learning modules. You can sell these courses on platforms like Udemy or Teachable. Developing your first course requires time but can be a fulfilling venture.

Focus on quality content and interactive elements to engage learners. I have created two e-courses so far with plans to launch two more in 2025. It’s always a good idea to keep creating products for the same core target audience. So, as they ask you deeper and evolving questions, create new products to help them solve those problems.

6. Ad Revenue

Earning ad revenue often involves running advertisements on websites or YouTube channels. Content needs to be engaging and consistent to attract and retain viewers. Subscribers and traffic volume significantly impact earnings.

Platforms like Raptive or Mediavine facilitate ad placement and income generation. Regularly analyzing performance metrics can help optimize content and increase ad effectiveness. This website is monetized with ads that pay based on the length of time a person spends reading, what country you are reading from, and if you click on any ads.

7. Affiliate Marketing

Affiliate marketing generates income through promotion of other brands. By sharing referral links, you can earn commissions on sales made through them. Aligning with products that match your niche is ideal. Engaging content encourages click-throughs and purchases.

Establishing credibility with your audience is essential for successful affiliate relationships. Don’t just be that blogger who says everything is great and push products with no regard to actual readers. Instead, weigh pros and cons, pinpoint if that product works for a specific type of person. Be honest when something sucks and steer your audience towards something better or nothing at all. Even if you don’t have an ideal product for them, you can earn money just by them reading the article if you have an ad network set up.

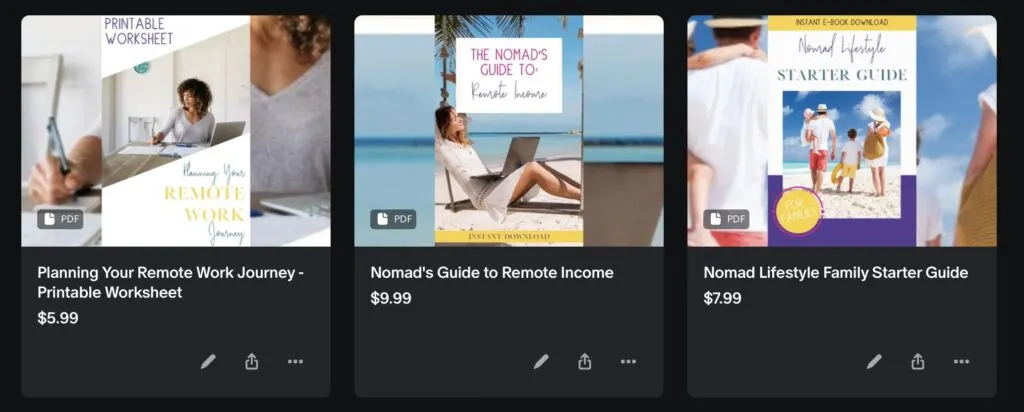

8. Digital Products

Digital products include items like eBooks, software, downloadable worksheets, and templates. Selling these products online can cater to a global audience. High-quality, innovative products that meet consumer needs stand out.

Effective marketing and engaging product descriptions capture interest. Platforms like Patreon, Kit, or your own website facilitate distribution. Your digital product offerings can be a low cost gateway into your entire product portfolio as. your audience grows in their ability to trust you.

9. Print on Demand

Print-on-demand services enable selling custom-designed products without inventory risks. Platforms handle printing, shipping, and fulfillment, easing the process. Unique and attractive designs are crucial for success.

Investing time to understand trends and consumer preferences can increase conversion rates. This business model suits creatives and entrepreneurs alike due to its flexible nature. Figure out what your ideal client would like to purchase around each major holiday and create products to fit those needs. Offer products that relate to your target market and niche because in most cases they would be happy to support your local business instead of a mega corporation.

10. Medium Partner Program

Writing under the Medium Partner Program can generate income through reader engagement. Compelling storytelling and insightful articles attract readers and recommendations. Building a loyal readership and consistently publishing content enhance earnings.

Engaging with the Medium community increases visibility and reach. The balance between niche writing and broader appeal is crucial for sustained success. I’ve iterated with multiple strategies on Medium and will continue to do so as time allows.

11. Coaching

Offering coaching services can capitalize on your expertise in specific areas. Clients value personalized guidance and actionable insights. Defining your niche and understanding client goals help tailor sessions effectively.

Building a strong reputation through testimonials and referrals boosts credibility. Online platforms allow you to reach wider audiences and deliver coaching sessions conveniently. Set prices high for one-on-one services so that you don’t get distracted from more passive income opportunities.

12. Stock Trading

Stock market trading involves buying and selling stocks in financial markets for profit. Understanding market trends and analysis is key to making informed decisions. Risk management strategies are important in protecting capital.

Utilizing trading platforms and tools for real-time data can improve outcomes. Continuous learning and adapting to market changes are crucial in this fast-paced environment. Be careful not to over invest funds you need immediate access to.

Future New Income Streams

Even thought I am quite diversified in my income streams, I regularly consider how I can expand my offerings to further provide value. The goal of my diversification is to get to a place where my passive streams are the only income I need to survive.

These are my next twelve ideas for income diversification. I always keep a list of ideas no matter how crazy they are so that as my skills grow and my time allows, I will have a roadmap for my next steps.

1. YouTube Channel

Starting a YouTube channel has been on my to do list for a long time. By creating engaging content, you can build an audience and monetize through ad revenue, sponsorships, and branded content. A valuable channel can also be a great lead source for your other revenue streams.

Consistent posting and engaging with your viewers are key to growth. Utilize SEO to ensure your content reaches a broader audience. As your channel grows, explore collaborations with other influencers to increase your reach.

2. Kindle Direct Publishing (KDP)

Kindle Direct Publishing (KDP) offers a straightforward way to publish your work online. Writing an e-book on a subject you have expertise in can establish you as an authority in that field. From fiction to industry-specific guides, the opportunities are vast.

My plan has been to teach my kids to make coloring and activity books based on the locations we visit. Every travel article I write could link to a product my kids created on KDP and create an additional revenue stream.

3. Books

The Ultimate Motivation Book

Coming Soon…

Don’t miss out on exclusive updates and breakthrough moments from ‘Stop Lying to Yourself.’

Join the Waitlist and be a part of the journey from the very beginning. Commit to the change you wish to see and experience. It all starts with the courage to confront your own story.

Publishing books is not a income stream for beginners. Consider whether traditional publishing or self-publishing fits your goals and resources. Both paths have distinct advantages, such as wider distribution with a traditional publisher or higher royalties with self-publishing.

Building an online presence and interacting with readers can enhance your marketing efforts. Having an existing platform is the biggest indicator of an authors ability to get a book deal by a major publishing house. Use platforms like Goodreads and author blogs to share insights and build anticipation for your releases.

4. Networking Group

Starting a networking group can create new revenue streams while providing value to members. Bring together professionals or enthusiasts in a specific industry and charge a membership fee. Organize regular meetings, workshops, and exclusive webinars to attract participants.

Partner with industry experts for special events, enhancing your group’s reputation. Leverage social media to promote events and engage with the community continuously. My dream networking group doesn’t exist yet, but it will once I have time to launch it.

5. Public Speaking

Public speaking can open numerous new income streams. Position yourself as an expert in your field and host workshops, seminars, and conferences. Develop a strong personal brand and showcase your knowledge to draw interest from potential clients.

Networking with event organizers can lead to more speaking engagements. Deliver presentations that provide clear value to attendees and leave them impressed, paving the way for future opportunities. Using your speaking platform expands your reach and ultimately gives you a wider audience to provide your entire product line to.

6. Membership Programs

Launching a membership program can provide consistent income. Offer exclusive content, resources, or services to paying members. Tailor your offerings to your audience’s needs, such as Q&A sessions, VIP webinars, or one-on-one consultations.

Promote your membership program through email marketing and social channels to attract and retain subscribers. Continually update content to maintain engagement and ensure prolonged interest in your program. An extremely valuable membership program is not just about the lessons learned, but also the network it creates among it’s members.

7. Sponsorships

Securing sponsorships can be a lucrative addition to your revenue streams. Present clear benefits to potential sponsors, highlighting your audience’s demographics and your reach. Create mutually beneficial collaborations where both parties can thrive.

Often, sponsors look for branding opportunities through events or content, hence maintaining high engagement can be pivotal. Regularly evaluate sponsorship deals to ensure they align with your brand’s values and goals.

8. Nomad Travel Planner

Normal planners don’t offer the level of detail a nomadic entrepreneur needs. As I travel the world I have made note of all the things I would like my planner to have. The level of detail needed and organization required hasn’t been created yet for a travel family.

My first made from scratch product will be the Nomad Travel Planner for nomadic families. I will be open for suggestions once I start the design process for this product.

9. Online Marketplaces

The most famous online marketplaces are Ebay, Airbnb, and Uber. All of these platforms own nothing but customer data. These platforms have a unique way to match buyers with sellers and take a commission in the middle.

As you grow in your niche there will be gaps in the marketplace you notice. Consider ways for the gaps to be filled by a marketplace where you can match suppliers with clients. There are countless industries that could benefit from a marketplace innovation.

10. Government Contracts

Securing government contracts can be a lucrative path for service providers. Understand the process and eligibility requirements for bidding on contracts. Develop a strong proposal highlighting your expertise and capacity to deliver.

Register with government databases to receive notifications of available contracts. Building a reputation for reliability and quality can bolster your chances of winning future contracts. Patience and persistence are crucial in navigating this competitive space.

11. Podcast

Starting a podcast can effectively engage audiences and establish multiple income streams. Choose topics that align with your knowledge and listener interests. Monetize through sponsorships, listener donations, or premium content.

Promoting your podcast via social media and collaborations can help grow your audience. Provide valuable and insightful content consistently to maintain listener interest and attract new subscribers.

12. Angel Investing

With angel investing, you can support startups while seeking potential financial returns. Evaluate emerging businesses in industries you understand well. Network with other investors to gain insights and share opportunities.

Conduct thorough research on startups’ business models and market potential. You bear risks with this strategy, so weigh your investments carefully and diversify to protect against failure. Engage actively with founders to provide guidance and enhance growth prospects.

Practical Advice for Building and Maintaining Multiple Income Streams

Creating multiple income streams can be a great way to achieve financial stability. Start by exploring your current skill set and identifying what you can offer. Content creators, for instance, might find opportunities in digital products. Using intellectual property like e-books or courses can cater to those seeking passive activities with minimal effort.

Business owners can consider diversifying. If you have a business model that works, think about branching it to further markets. Diversifying your investments with little money allows you to explore ventures without significant upfront investment. This step keeps profit margins positive.

Maintaining your streams requires attention and care. Passive activities like renting your property can add to your income. Keep your day job for stability while experimenting with new streams requiring little time. Utilize strategies that demand minimal input and ensure consistent full-time income.

Don’t rush; take time to understand what suits you. The best way to maximize income is aligning with your interests. Regular jobs provide security, but having side ventures hedges against unexpected changes. Smart choices can become easy money, turning your efforts into wealth.

Building a Diverse Financial Foundation

Creating a secure financial future involves more than just earning money—it’s about establishing a solid foundation with multiple income streams. Start by assessing your current financial goals. Consider consulting a financial advisor who can offer personalized advice. This expert guidance can help you navigate the complexities of long-term financial planning.

Diversification is key to stability. Invest in a variety of assets to spread risk effectively. Build an investment portfolio including stocks, bonds, and real estate. This strategic mix can protect your finances from market fluctuations over time, providing both growth and security.

When considering business activities, think about the potential for passive income. Businesses that can operate independently with minimal input from you are ideal. Automate as much as possible to ensure your business activities don’t become additional jobs but instead grow as valuable parts of your financial foundation.

Assess your initial investment needs. This may include the savings required to start a business or make a significant stock purchase. Properly planning your initial investment can positively impact your long-term financial health, minimizing start-up risks and maximizing potential returns.

Consistently review and adjust your plan. As your circumstances and market conditions evolve, so should your strategy. Regularly assess progress towards your financial goals, making necessary adjustments to ensure continued alignment with your aspirations. This proactive approach allows for ongoing growth and resilience in your financial journey.

Journey of Financial Independence

Achieving financial independence is an exciting prospect. By embracing multiple income streams, you empower yourself to create a secure and prosperous future. This journey requires diversifying your financial foundation through various income sources.

Start Small: Begin with manageable side hustles. Explore opportunities like affiliate marketing, blogging, or freelancing.

Invest Wisely: Automation solutions can help you consistently save and invest, potentially growing your wealth over time.

Stay Motivated: Align your income-generating activities with your passions and skills. Doing what you love not only brings financial gain but also personal satisfaction.

Diversification helps shield you from financial instability. With numerous income streams, a downturn in one area won’t heavily impact your overall financial health.

Adapt and Grow: Be prepared to evolve. The financial landscape changes, and so should your strategies. Keep learning and adapting to new opportunities.

Remember, each step you take brings you closer to the financial freedom you desire.